Imagine a way to grow your wealth that doesn’t just sit idle but builds in value with every deposit. With GoldSaver, you’re building wealth in gold & silver one payment at a time.

Start small, dream big

Begin with as little as $50 per month. Choose gold, silver, or a mix of both. GoldSaver makes it easy to secure your future, on your terms.

Save your way

Set up automatic deposits weekly, fortnightly, or monthly, and adjust your payment amount and frequency with just a few clicks. Create sub-accounts for children, grandchildren, or any savings goals of your choice. You’re always in control.

Watch your wealth grow

Every deposit is converted into real gold, silver or a mix of both based on the day’s spot price. Watch your investment grow over time. Need to sell? You can cash out whenever you choose.

How It Works

Your precious metals are pooled with other account holders, allowing you to access gold and silver at competitive prices until you choose to sell or convert them into a product of your choice. While your deposits contribute to a shared pool, your investment remains fully yours, securely stored and insured at no cost to you.

REGISTER

Sign up online to Goldsaver, in just a few minutes.

GET VERIFIED

Complete a quick ID verification to secure your account.

Start Saving

Set up your deposits and begin growing your wealth in gold and silver

WHAT YOU’LL GET

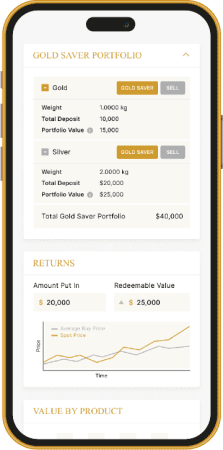

With GoldSaver, you’ll have access to a personalised dashboard where you can track your portfolio in real time.

View your gold and silver holdings, check your current portfolio value, and easily manage your account. You can adjust your Direct Debit amount online, skip a payment, or reduce your contribution to as low as $50 per payment.

You’re also free to change your allocation – switch between gold, silver, or any mix of the two – all with just a few clicks.

For even more flexibility, you can split your payments into sub-accounts for children, grandchildren, holidays, or travel, helping you save for multiple goals at once.

With GoldSaver, I started saving in gold and silver with just $50 a week. My savings grow with every click, it’s awesome!

Milly, Auckland

Why We Created GoldSaver

At New Zealand Gold Merchants, we wanted to make gold ownership accessible to everyday savers—not just large-scale investors. That’s why we created GoldSaver, a modern alternative to traditional bank accounts.

Over the past 20 years, gold’s price in NZD has risen by 798% — including a 38% increase during the last year*. It can offer advantages over company shares or simply parking money in a savings account with a bank, as most Kiwi savers do.

Once an asset reserved for the wealthy, gold is now within reach for anyone looking to build long-term savings, one small payment at a time.

FAQs

Getting Started

What’s the minimum deposit amount?

The minimum deposit is $50, whether weekly, fortnightly or monthly.

What’s the minimum amount I can contribute per month?

$50.

What deposit frequencies are supported?

You can deposit weekly, fortnightly or monthly. Payments are made on a Thursday only.

What documents do I need to open an account?

To open a GoldSaver account, you’ll need to provide proof of identity — either a valid driver’s licence or passport. All account verifications are completed through Cloudcheck, a secure electronic ID verification service.

Can I choose my direct debit day?

No — all payments are processed on Thursdays. Our system requires a set day of the week to make deductions. Research indicated that Thursday was the most preferred day of the week.

Can I pay without using other methods?

No. GoldSaver only accepts direct debits. Precious metals can be purchased using credit cards, Debit cards, or cash, either online or in person. However, these are separate from GoldSaver and do not count as GoldSaver purchases.

How GoldSaver works

Can I give you my existing gold or silver to add to my GoldSaver account?

GoldSaver does not accept transfers of existing metal. Only purchases made through the GoldSaver system can be added to your account.

I have existing gold and silver holdings with New Zealand Gold Merchants. Can I move them into GoldSaver?

Unfortunately not. GoldSaver operates separately and does not accept transfers of existing holdings.

Can I make one-off payments or deposits directly?

Again, unfortunately not. The GoldSaver system is automated and requires direct debits for tracking.

Do I earn interest on my GoldSaver balance?

Like physical metal, GoldSaver holdings do not generate interest.

Are returns guaranteed?

Returns are not guaranteed. Like all precious metal investments, GoldSaver is subject to market fluctuations. The value of your holdings may go up or down based on the global price of gold and silver.

Can I cash out or convert to physical metal?

Yes, please see Buying and Selling Metal section to learn more.

Tax, Fees & Charges

Does investing via GoldSaver qualify for any GST exemptions or tax benefits, and will NZGM provide documentation for tax purposes?

The gold and silver sold through GoldSaver are investment-grade and therefore zero-rated for GST under New Zealand law. NZGM provides invoices and statements for your records, but we do not offer tax advice. For all other tax matters, please consult your professional advisor

Are there storage or insurance fees?

No. NZGM covers all storage and insurance costs on GoldSaver accounts.

Are there admin or closure fees?

There are no fees for closing your account or making admin changes.

What if I want to store transformed products?

Storage charges apply only when gold or silver is transformed from your pooled metal GoldSaver account into a physical form and stored with New Zealand Gold Merchants as allocated storage.

Managing Your Account

What online tools are available for monitoring my account and managing settings?

Your personal GoldSaver dashboard — accessible when logging into your account at gogold.co.nz — allows you to:

- View your current gold and silver holdings and their value

- See your full transaction history

- Select and adjust your deposit split between gold and silver

- Change your direct debit amount and frequency (weekly, fortnightly, or monthly)

- Pause up to three direct debit payments

- Cancel your direct debit at any time

- Add sub-account names for up to six family members (note: these are part of your main account and cannot be transferred)

Can I change my deposit amount or frequency?

Yes — log in to your dashboard to adjust your settings.

Can I make one-off top-ups?

No. GoldSaver only supports scheduled direct debits.

Why was my payment dishonoured when I had money in the bank?

Even if you had funds in your account, your payment may have been dishonoured due to one of the following reasons:

- Dishonour Code 01: Your bank account suffix doesn’t allow direct debits. Try a different suffix or contact your bank.

- Dishonour Code 02: The bank account number you entered is invalid. Cancel your GoldSaver setup and re-activate it using the correct details.

- Dishonour Code 03: There is insufficient funds to meet your payment. New Zealand Gold Merchants will not retry to obtain payment if this occurs. Three dishonours will see your Direct Debit automatically cancelled.

- Dishonour Code 04: You have stopped payment.

- Dishonour Code 05: Direct Debit Authority cancelled by you.

- Dishonour Code 06: Your bank account has been closed.

Can I change my bank account number?

Yes. To change your bank account details, you’ll need to cancel your current GoldSaver direct debit and set up a new one using your updated account details. This is because your original authorisation only allows us to withdraw from the specific account you registered. A new bank account requires a new authority.

When does my metal show in my account?

Direct debits are processed every Thursday. Invoices are issued and emailed on Friday. To allow for any dishonoured payments, your metal balance is updated the following Tuesday.

Do I receive certificates for my purchases?

Pooled products are not individually certified. You will receive an invoice and payment receipt via email each time you purchase.

Buying & Selling Metal

How is my gold or silver tracked in a pooled account, and how do I know it’s secure?

Each GoldSaver client’s holdings are individually tracked in our comprehensive CRM system. You can view your gold and silver balances, along with their current value, by logging into your account at gogold.co.nz. The total physical pool of gold and silver is securely stored in our vaults, held separately on behalf of GoldSaver clients.

Can I sell my GoldSaver metal at any time?

Yes, and there’s no minimum to sell back to New Zealand Gold Merchants. However, if you wish to transform your holdings into physical product, you must have at least 5oz of silver or 0.5oz of gold to transform your GoldSaver balance into physical product.

Can I cash out my GoldSaver holdings instead of transforming to physical allocated metal?

Yes, you can sell your GoldSaver holdings at any time by contacting New Zealand Gold Merchants during business hours on 0800 105 334 or by email. Payment is usually made the same day and will only be made to the bank account linked to your direct debit.

How do I transform my GoldSaver balance into allocated physical gold or silver, such as bars or coins?

To convert your holdings into physical product, you must have at least 5oz of silver or 0.5oz of gold in your account. Once you meet the minimum, choose the product you’d like (e.g. silver coins or a 1oz NZ Pure gold bar) – you can view the catalogue here – and call 0800 105 334 to begin the transform process with our team.

What are the minimum amounts I can transform to allocated physical gold or silver?

You must have at least 5oz of silver or 0.5oz of gold to convert your GoldSaver balance into allocated physical product.

How is the transform price calculated?

When you buy through GoldSaver, you pay 1.5% above the spot ask price.

This 1.5% margin will then be deducted from the spot price plus the margin of the particular product you select.

Example:

You want to convert 1oz of gold into an NZ Pure 1oz cast bar (retail price: 2% above spot).

You’ve already paid 1.5% over spot via GoldSaver, so you pay the remaining 0.5% to complete the conversion.

How long does the transformation take?

Once a conversion is initiated, it is usually completed within 24 hours, after which your product will be available for pick-up or delivery (subject to product availability and office hours).

I want to transform my GoldSaver holdings to a allocated physical product. Can I place an order for the product I want in the online store?

Unfortunately not — ordering this way creates a separate invoice, outside of GoldSaver, requiring payment. Once you’ve accumulated sufficient metal, you can transform it into the product you want, but you must contact our team once you’re ready to transform your holdings. If you choose to store the transformed product, storage fees will apply.

Can I accumulate and transact in fractional-gram amounts (e.g. 0.1g), or are top-ups limited to whole grams?

Yes, your GoldSaver holdings are measured to four decimal places. You can view this on your portfolio page after logging in.

Privacy, Security, Storage & Insurance

Where is my metal stored?

Your gold and silver are securely stored in New Zealand Gold Merchants’ private vaulting facilities in New Zealand. The exact location is not disclosed for security reasons.

Can I arrange a third-party inspection of my holdings?

No, site visits and third-party inspections are not permitted. Only authorised parties have access to the vault as part of regular compliance checks.

Is my metal insured?

Yes. GoldSaver product is fully insured.

Who underwrites the insurance on GoldSaver holdings, and is there a maximum insured amount per account?

GoldSaver holdings are covered under our global stock holding insurance policy, brokered through Gallagher in London. This policy covers all client and NZGM-owned metal, including both allocated and pool-allocated gold and silver, and is reviewed regularly. There is no individual account limit specified, as coverage applies to the total insured stock.

Is my metal audited?

Independent audits will be conducted.

What privacy safeguards apply to my account, and could my data be shared with government authorities?

New Zealand Gold Merchants takes your privacy seriously. Your personal data is securely stored and only accessible to authorised staff for account management purposes. We do not share your information with any government department. However, we may be legally required from time to time, to release information if served with orders by a New Zealand court or other legally entitled entities.

In the event of my death, what steps must beneficiaries take to access my GoldSaver account?

As part of upcoming product updates, customers will be asked to provide next-of-kin details when logging in. Until then, your Executor can contact NZGM directly to manage the transfer or redemption process.

What Know‑Your‑Customer (KYC) and Anti‑Money Laundering (AML) documents are required to open a GoldSaver account?

To open a GoldSaver account, you’ll need to provide proof of identity — either a valid driver’s licence or passport. All account verifications are completed through Cloudcheck, a secure electronic ID verification service.

Statements, Notifications & Support

How will I be notified of changes to fees or terms and conditions?

You will be notified via email. We will also publish the updated terms and conditions online.

Will I get account statements?

Yes — quarterly by email (with PDF attachment). You can also access your statements by logging in online.

How can I contact support?

Email: goldsaver@gogold.co.nz

Phone: 0800 105334 (during office hours)